Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Just choose the course level that you’re most interested in and get started on the right path now. When you’re ready you can join our chat rooms and access our Next Level training library. Our content is packed with the essential knowledge that’s needed to help you to become a successful trader. We realize that everyone was once a new trader and needs help along the way on their trading journey and that’s what we’re here for.

That level is now routinely violated, with the .786 retracement offering strong support or resistance, depending on the direction of the primary trend. Traders and market timers have adapted to this slow evolution, altering strategies to accommodate a higher frequency of whipsaws and violations. Similarly, candlestick patterns, such as engulfing patterns or pin bars, near a Fibonacci level can act as confirmation for entry or exit points. These patterns can indicate potential market reversals or continuations, and when seen near Fibonacci levels, they strengthen the probability of the anticipated price move. There’s no guarantee that these levels will always hold, and price can sometimes break through support or resistance without warning. This is where Fibonacci levels come in, offering a useful tool for confirmation and enhancing the accuracy of your analysis.

Interaction with Other Indicators

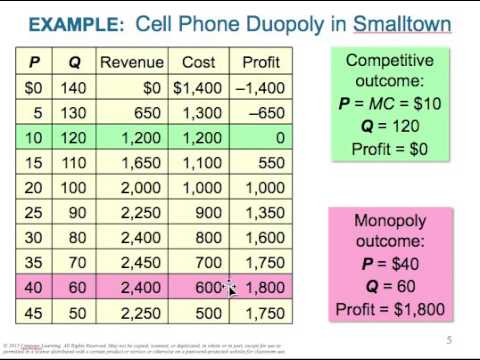

After plotting the retracement levels, traders look for signs that the price might reverse or find support/resistance at what is fibonacci in forex these levels. Our recommendation is to always use Fibonacci forex trading strategies in combination with other tools and insights. Whilst useful indicators, Fibonacci forex trading levels cannot actually guarantee a pivot point. The price may not reverse at a Fibonacci level or any other estimated level for that matter. They can be used to identify areas of interest but cannot guarantee a specific point of change. To start trading using Fibonacci retracement levels in an uptrend, you need to see whether the price finds support at 38.2% and 50% retracement levels.

Using the Fibonacci Tool on the Trendo Broker Trading Platform

Fibonacci retracement is a technical analysis tool used to predict the potential support and resistance levels during a market pullback or retracement. When the market moves in a particular direction, such as an upward trend, it is common for the price to pull back temporarily before continuing in the same direction. Traders use Fibonacci retracement levels to identify where these pullbacks might stop and where the price might resume the original trend. The theories about market movement, using technical analysis, are based on pure mathematical analysis. If the assumptions being made are wrong, then the trade will turn against you.

- Fibonacci serves as a valuable confirmation tool, adding precision to your decision-making process and reducing the risk of false breakouts.

- Always remember that when you draw Fibonacci Retracement in an upward trend, you draw the horizontal line from the swing low to the swing high.

- Fibonacci retracements are not a foolproof trading strategy, but they can be a useful tool in a trader’s toolbox.

- Fibonacci levels are a powerful tool in forex trading, offering significant insights into market behavior.

- Some traders find Fibonacci analysis particularly effective on pairs that exhibit clear trending behavior.

- To apply Fibonacci levels to your forex charts, you need to identify a significant swing high and swing low.

Trade Preparation

Always remember to consider risk factors and never base decisions on a single tool or method. Higher timeframes (daily, 4-hour) typically provide more reliable Fibonacci signals with fewer false reversals. However, once you’ve identified key levels on higher timeframes, you can shift to lower timeframes (1-hour, 15-minute) for precise entry timing.

Forex Brokers With Fibonacci Chart Patterns

- You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- This gives me more confidence in the importance of those levels and I would exepct them to either cause a price reversal or breakout.

- In a single day there will be multiple price swings, meaning that not everyone will be connecting the same two points.

- Since currency pairs oscillate between contained boundaries through nearly all economic conditions, these historical levels can impact short-term pricing for decades.

- Fibonacci numbers are of interest to biologists and physicists because they are frequently observed in various natural objects and phenomena.

- Built for you, our extensive trading environment combines ease-of-use with a full range of tools, enhancing your trading prowess at every step.

These levels can be used to set profit-taking targets once the trend resumes after a retracement. If you are new to forex trading, you may have come across the term “Fibonacci levels” and wondered what it means and how it can be used in your trading strategy. Fibonacci levels are a powerful tool that can help you identify potential price targets and areas of support and resistance. In this beginner’s guide, we will explore the concept of Fibonacci levels and how you can use them to improve your forex trading.

Here we plotted the Fibonacci retracement levels by clicking on the Swing Low at .6955 on April 20 and dragging the cursor to the Swing High at .8264 on June 3. In order to find these Fibonacci retracement levels, you have to find the recent significant Swing Highs and Swings Lows. Having a hard time figuring out where to place starting and ending points for Fibonacci grids?

For instance, if the price retraces to a 50% Fibonacci level and also coincides with the 50-period moving average, it strengthens the case for a potential bounce. From ancient architecture to modern financial analysis, they demonstrate how natural patterns can provide insights into seemingly unrelated fields. This sequence is now a cornerstone in trading, offering a reliable method to interpret market behavior with mathematical precision.

Forex Market Technical Analysis

Yes, we work hard every day to teach day trading, swing trading, options futures, scalping, and all that fun trading stuff. But we also like to teach you what’s beneath the Foundation of the stock market. As with any technical indicator, seeking additional confirmations to support your initial analysis is better.

Markets

If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader. Also, we provide you with free options courses that teach you how to implement our trades as well. Our watch lists and alert signals are great for your trading education and learning experience.

Technical analysis is both effective and approachable, since virtually anyone can find a way to use it in their trades. The fundamental analysis, on the other hand, requires large amounts of training and preparation. It is best to focus on the technical aspects at first and leave the fundamental analytics to professionals. Many traders will agree that there is certain beauty to Forex market technical analysis.

Set your stop order 4 to 5 pips above your Fibonacci retracement level in a downtrend and 4 to 5 pips below in an uptrend. A Fibonacci Forex tool can be a great way to find support and price targets. Look at the retracement levels when you’re in a trade or looking to get into one. There are many theories, mathematical equations, and strategies to try to make sense of a market that’s largely speculative. However, traders widely accept that most major moves will retrace around the Fibonacci Forex levels. If the price moves beyond the 61.8% level, it might signal that the trend direction is changing permanently.

By leveraging these mathematical ratios, derived from nature’s patterns, traders can pinpoint entry and exit points with greater precision. The first step is to identify the high and low points of a price movement. This can be done by looking at a chart of the currency pair and finding the highest and lowest price points over a given period of time. It is important to remember that trading by Fibonacci levels is, to a greater extent, based on probabilities.

Trendlines and candlestick patterns are core components of technical analysis. Trendlines help identify the direction of price movement, while candlestick patterns offer insights into market sentiment. However, when combined with Fibonacci levels, they offer stronger signals that can significantly increase the likelihood of a successful trade.

By understanding how to correctly apply retracements and extensions, traders can identify promising entry points and profit targets. Remember that Fibonacci tools work best when used alongside other analysis methods and within a proper risk management framework. With practice and patience, these mathematical relationships can become a valuable part of your trading approach.

.jpeg)

.jpeg)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)